Spread Analysis

FX Blue Labs can collect price data over FIX or through a trading platform such as MT4, and then display and analyse spread information. Three main services are available:

- Weekly (or monthly) summary of spreads: average, maximum, minimum

- Live spread view/comparison

- Live and historic spreads for VWAP volumes as well as BBO - show your large traders the spreads they will actually experience, rather than top-of-book

FX Blue Labs can collect multiple feeds, including a combination of FIX/MT4/MT5 etc, and present them in a single consolidated view.

The spread analysis and visualization can either be solely for a broker's internal use, or can be made available to clients as simple widgets which you can embed on your website.

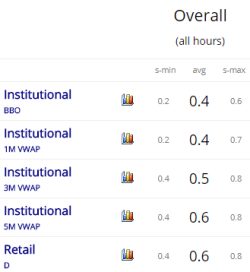

Spread summary/analysis

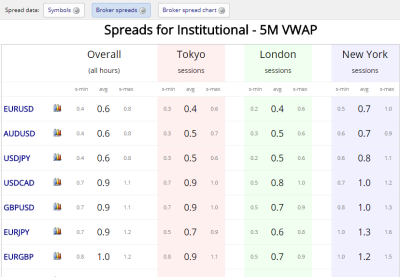

Spread summaries are typically compiled weekly. For each price feed, we calculate the average, maximum, and minimum spread for the whole week. We also calculate the average/maximum/minimum during specific sessions of the day such as London, New York and Tokyo.

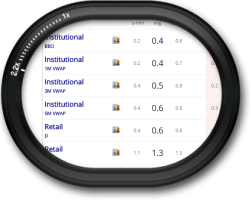

Data can be viewed either per instrument, comparing different feeds, or per feed, listing all the instruments collected through that feed:

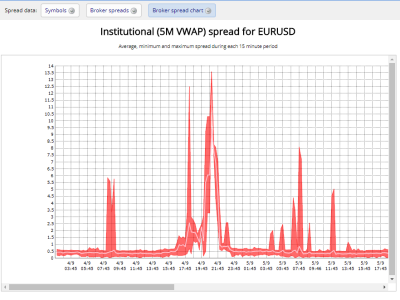

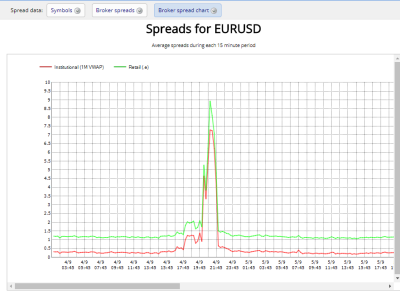

The historic spread can also be charted, showing either the spread for a single feed (its average in relation to its minimum and maximum), or comparing the average spreads on two or more feeds:

VWAP spread

If we are receiving a full order book, over FIX, rather than just top-of-book, then we can calculate the VWAP spread for particular volumes such as 5 million or 10 million as well as the BBO spread. The VWAP spread can then be compared and charted against the BBO spread, or against other feeds.

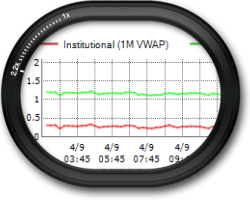

For example, zooming in on the screenshots above:

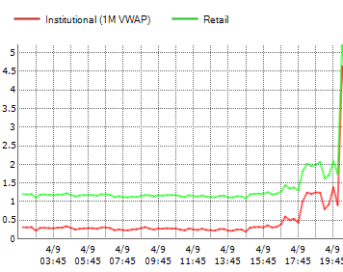

Live spreads

In addition to the weekly summary, live spreads and prices can be viewed and compared using our tick-chart widget. Again, if collecting the price data over FIX, we can display spreads for VWAP volumes, in real time, as well as top-of-book:

Competitor analysis

We can collect price/spread data from competitors, and include it in the spread analysis and display alongside your own feeds.

We normally use demo accounts for this purpose. The price feeds are usually identical to, and fully indicative of, the price feeds on real-money accounts. (What changes is not the price but the execution.) For obvious reasons, it is not usually possible to collect a competitor's full order book over FIX, and to calculate VWAP spreads.

Website widgets

All the spread information can be provided as widgets for display on your website, to clients/visitors, as well as for internal use. All widgets are fully configurable in terms of size/colours/languages etc.

Depth of market

If you are providing FIX credentials for us to collect a full order book and VWAP spreads, then we can also use those details to provide our depth of market services: display of the depth within our add-ons for trading platforms such as MT4, and/or a widget for displaying the market depth on your website.